SEBI sets up panel on hybrid securities

Context

SEBI has set up an advisory committee on hybrid securities, which will make recommendations for giving a fillip to the growth of such instruments, including measures focusing on ease of issuance and attracting domestic and global capital.

What are Hybrid Securities?

- Hybrid Securities are financial instruments that have mixed characteristics of two or more different financial instruments like stocks or bonds.

- These are defined under Section 2 (19A) of the Companies Act, 1956 as “any security which has the character of more than one type of security, including their derivatives”

- These are hence called ‘hybrids’ because they have mixed characteristics of both equity and debt.

SC on Hybrid Securities

- The Supreme Court dealt with the issue of whether ‘hybrid’ securities are ‘securities’ as per the scheme of the Companies Act and SEBI Act in the case of Sahara India Real Estate Corporation Limited & Ors. v. SEBI.

- In this case, the Supreme Court held that ‘hybrid securities’ are securities within the meaning of the Companies Act, Securities Contracts Regulation Act and hence the SEBI Act too.

- It based its decision on the fact that Section 2 (h) of the Securities Contracts Regulation Act, 1956 defines securities to include “shares, scrips, stocks, bonds, debenture stocks, or other marketable securities of like nature in or of any incorporated company or other body corporate”.

- The term ‘hybrids’ has been defined as ‘any security having the character of more than one type of security’ and since these securities are ‘marketable’ they would fall within the meaning of securities for the purposes of Companies Act, Securities Contracts Regulation Act and the SEBI Act.

|

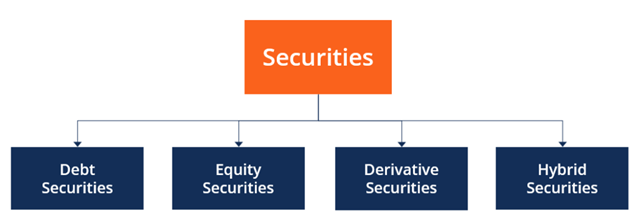

Security is a financial asset that has some monetary value and is used by the companies to raise capital, while it is used by the investors to invest in a company. |

Different types of Hybrid Securities

- Convertible Bond

- Preferred Shares

- Mezzanine Financing

- Toggle Notes

- Warrants

|

Advantages |

Disadvantages |

|

|