Taxation in India: Genesis, Evolution and Current Perspective

The word ‘tax’ has been derived from the Latin word taxare or taxo, meaning ‘to assess the worth of something’. Taxation in any economy is an essential part of financial management as any government of the world requires huge revenue to manage and run its administration, spend money on essential public services such as health and education and infrastructure such as roadways

Introduction

The word ‘tax’ has been derived from the Latin word taxare or taxo, meaning ‘to assess the worth of something’. Taxation in any economy is an essential part of financial management as any government of the world requires huge revenue to manage and run its administration, spend money on essential public services such as health and education and infrastructure such as roadways, railways e.t.c. Apart from it, the government needs to manage the country's defence, uplift its economically weaker section by providing subsidies and pay its employees. Taxation in Indian economy is present from ancient time, as Kalidasa writes about necessity of collection of taxes by King:

"It was only for the good of his subjects that he collected taxes from them, just as the Sun draws moisture from the Earth to give it back a thousand fold"

-Kalidas in Raghuvansh

Modern Perspective of taxation in an Economy

|

Historical Perspective of Taxation in India

Taxation in Ancient India

- In ancient India, most of the taxes were levied either on the sale and purchase of merchandise or livestock and were collected in a haphazard manner from time to time.

- However, the system of direct taxation emerged later. There are references both in Manu Smriti and Arthasastra to a variety of tax measures. However, there were no taxes which were levied directly on income.

Manusmriti on Taxation

- According to Manusmriti, there was a well planned taxation system in which traders and artisans had to pay 1/5th of their profits in silver and gold, while the agriculturists were to pay 1/6th, 1/8th and 1/10th of their produce depending upon their circumstances.

- Similarly, taxes were also levied on various classes of people like actors, dancers, singers and even dancing girls. Taxes were paid in the shape of gold-coins, cattle, grains, raw-materials and also by rendering personal service.

Arthashastra: Bible of ancient Indian taxation System

- Kautilya's Arthasastra provides a well described form and hierarchy of taxation. According to it, collection of land revenue formed an important source of revenue to the Mauryan State.

- The State collected one-sixth of the tax on agricultural produce, levied water tax, octroi duties, tolls and customs duties. Taxation was also applied on forest produce, mining of metals and extraction of Salt.

- Levies called ‘Vartanam’ and import duty called ‘Dvarodaya’ was collected from importers from neighbouring countries such as China and Ceylon.

- Income Tax constituted a major form of tax collection during the Mauryan administration which was collected from dancers, musicians, actors and dancing girls, etc.

- Pilgrimage taxation called ‘Yatravetana’, gambling tax and sales tax on sale and purchase of buildings was also levied by the Mauryan administration.

Taxation during Gupta Era

The Gupta era is called the golden period of Indian history as it witnessed different developments in the form of art and architecture and administration. There were different types of taxes which were imposed during this period creating huge revenue.

- Kalpita/ Upkilpta: This was sales tax which was imposed during the Gupta period.

- Halivakar/ Halidanda: This was a tax which was levied during the cultivation.

- Prataya: Toll tax levied during the Gupta Period.

- Bhog: It was the King's share of total agricultural produce.

- Bhatta: It was ‘Police Tax’ levied during Gupta Period.

- Similarly other types of taxes such as Security Tax (Chat), Grazing Tax (Charashna), Tax on special produce Tax on special produce (Hiranya) e.t.c. was taken.

- Gupta rulers also levied taxes on irrigation (Bedakbhog), navigation tax and Tax for measurement of land (Rajju).

- The volume of taxation during the Gupta period laid the foundation of one of the mightiest empires of ancient Indian history which widely saw the development of trade, cities and culture.

Taxation in Medieval India

The Medieval period saw the emergence of two most developed centralized administrations in the form of ‘Delhi Sultanate’ and ‘Mughals. These two empires imposed a variety of taxes on their subjects.

Delhi Sultanate

- Khiraj: Land revenue, also called ‘Khiraj’, was the major source of income during the Sultanate Period. It was generally realized at 1/5 of the total produce, though the Sultans like Ala-ud-Din Khilji and Muhammed Tughlak raised it to 1/2 of the produce.

- Jazia: The Jazia Tax was levied on the Non-Muslims. However, children, women and friars were exempted from its payment. It was realized at the rate of 10 to 40 takas depending on the payer’s income.

- Octroi Duty: This duty was levied on the exchange and transportation of commercial goods which included import tax on imported goods.

- Zakat: It was a minimal amount of tax which was levied on Muslims only during the sultanate period.

- Ghari Tax: It was a house tax which was imposed by Allauddin Khilji.

- Chari Tax: This tax was also introduced by Alauddin Khilji and was levied on pastures.

- Water Tax or Irrigation tax: This tax was introduced by Firoz-Shah Tughlaq. This tax was known as Haque-i-Sharb or Hasil-i-Sharb and was dedicated for construction of a series of canals.

Reforms in taxation during the Mughal era

- The taxation during the Mughal era was partially based on the old system as inherited from the Sultanate era. But there were some remarkable reforms which were introduced by Akbar during this period.

-

- Todarmal Bandobast: This system, also called ‘Ain-i-Dahsala, was introduced during Akbar's reign. It was based on average of the produce and prices during the last ten years. It shielded the cultivators from crop failures by demanding average tax over a period.

- Batai: Batai or ghallabakshi (crop-sharing) system was also introduced by Akbar where the crops were reaped and taxation was taken in the form of physical crops. It was of three types:

- Bhaoli: Crops were stacked after reaping and were divided between tax collector and taxpayer.

- Khet Batai: Land was divided and crops grown were taken by respective parties.

- Lang Batai: Grain obtained from crops was divided among parties.

- Nasaq: This system of land revenue was assessed during the Akbar’s time and the peasant was given remission in the land revenue if crops failed on account of drought, floods, etc.

- Jagirdari System: This system was based on ‘Jagirs’ or parcels of land which were given to ‘Jagirdars’ and they were entitled to collect and pay revenue to the Mughal administration.

Taxation System under Marathas

- Chauth: Chauth’ was essentially a military contribution which paid toward any attack of the Marhatas. It was ¼ of revenues of the district invaded by Maratha raiders.

- Sardeshmukhi: Sardeshmukhi was an additional 10% tax which was collected directly by the central administration of the Marathas.

Advent of Europeans and taxation system under the British Rule

- The British introduced western taxation system in India chiefly in order to finance their army and administration. ‘Income tax’ was the first tax introduced by the British. The modern Indian taxation system is the result of evolution of the British taxation system.

- After the ‘Government of India Act, 1858’, the British Crown rule began in India. During this time, the finances of the three major presidencies i.e. Bombay, Bengal, and Madras were nearly autonomous.

- The basic structure of federal finance was established in the first twenty years of British rule.

- According to this arrangement, taxes such as customs, salt tax, opium tax, and railway income were the main revenues raised and used exclusively by the central government.

- Receipts of provincial administrative departments, such as law and justice or education, went only to the provinces. Land revenue and excise taxes were shared between the centre and Provinces.

Taxation on land under British

- There were three systems of taxation on land which were introduced by the British. These were:

- Zamindari System: Zamindari System was introduced through the Permanent Settlement Act, 1793. According to it, ownership of lands were transferred to Zamindars who were authorized to collect taxes (fixed) and pay to the British in cash.

- Ryotwari System: This system was developed by Thomas Munro in 1820 in South India. Madras, Bombay, parts of Assam and Coorg provinces of British India were covered under it. The ownership rights were handed over to the peasants under this system who were entitled to pay taxes directly.

- Mahalwari System: Holt Mackenzie introduced this system in 1822 in regions Central Province, North-West Frontier, Agra and Punjab. A unit called ‘Mahal’ was constituted of one or more villages. It was collectively liable to pay taxes.

First Budget and Income Tax

- In 1860, the first Union Budget was presented by British Economist Sir James Wilson. There were three types of taxes introduced for the first time. These were income tax, license tax and tobacco duty.

- The Indian Income Tax Act of 1860 was enforced to give a statutory backing of the first direct tax of the country.

- These taxes were imposed to meet the losses sustained by the government on account of the military mutiny of 1857.

- On the demand of the governor-general of India, Charles Canning, license tax and tobacco duty was abolished.

- The ‘Income tax’ was to be levied in four different categories. These are:

(1) Income from landed property,

(2) Income from professions and trades

(3) Income from Securities

(4) Income from Salaries and pensions.

Other forms of taxes

- Salt Tax: British levied salt tax through the Salt Act of 1882. It also prohibited Indians from collecting or selling salt and ceded the salt trade monopoly to the British. Taxation on salt was removed only after ‘Salt Satyagrah’ which started after ‘Dandi March’ by Mahatma Gandhi.

- Custom Duty: From 1846 the British instituted a uniform tariff rate scheduled at 3.5 percent on cotton twist and yarn and 5 percent on all other goods which were imported from Britain.

- Further, after ‘The Great Depression’ this rate was increased up to 15 percent for all British goods and 20 percent for all non-British imports.

Taxation by Urban Local Bodies (ULBs)

- Taxation for Urban Local Bodies in India was brought by Lord Ripon’s Resolution which was brought in 1882. He is hailed as “Father of local self-government in India.”

- Ripon suggested reforms for instilling life into the local bodies. He advocated the establishment of a network of locals governing institutions, financial decentralization e.t.c.

- The Municipal Taxation Act, 1881 gave power to municipalities to raise funds for development and infrastructure through taxation.

Taxation in India after Independence

Post-Independence India needed a subtle and efficient taxation system which would have helped it to finance its infrastructure projects and eradicate poverty and hunger. Direct taxes and indirect taxes evolved slowly after independence.

Evolution of Direct Taxes after independence

- Direct taxes are currently levied by centre and state separately. These are:

|

Central Direct Taxes |

State Direct Taxes |

|

Personal Income Tax |

Land Revenue Tax |

|

Corporate Income Tax |

Property Tax |

|

Minimum Alternate Tax |

|

|

Capital Gain Tax |

|

|

Dividend Distribution Tax (Abolished in 2021) |

|

|

Securities Transaction Tax |

|

|

Equalization Levy |

Direct taxes levied by the Central Government

Personal Income Tax

- Personal Income tax was first proposed during India’s first Union budget in 1860. Currently, the Income Tax Act, 1961 provides statutory backing of income tax in India. It provides taxation in case of following five types:

- Income from Salary

- Income from House Property

- Income from Profits and Gains of Business or Profession

- Income from Capital Gains

- Income from Other Sources

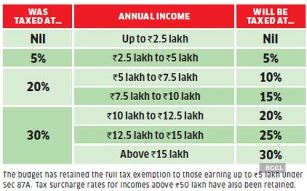

- Currently, Income tax is levied in slabs and is differential in nature.

Corporate Income Tax

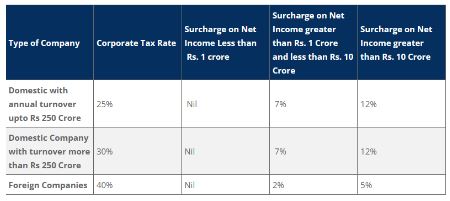

- The income-tax paid by domestic companies, and foreign companies on their income in India is corporate income-tax (CIT). It was levied for the first time in 1860.

- It is at a specific rate as prescribed by the Income Tax Act, 1961 which is subject to the changes in the rates in the union budget every year.

- In India, there is differential taxation for domestic companies and foreign companies. While a domestic company (registered under the Companies Act of India or totally managed from India) is taxed on its universal income.

- A foreign company is only taxed on the income earned within India i.e. is being accrued or received in India.

- Current Corporate taxation in India is:

Minimum Alternate Tax

- Minimum Alternate Tax is a provision in Direct tax laws to limit tax exemptions availed by companies. Due to an increase in the number of zero tax paying companies, it was introduced by the Finance Act, 1987 with effect from assessment year 1988-89.

- It envisages that at least a minimum amount of corporate tax is levied by the government as it ensures minimum levels of taxation for all domestic and foreign companies in India.

- Currently it is charged at 15% of book profit (plus surcharge and Health and Education cess as applicable).

Capital Gain Tax

- The capital gains tax is the levy on the profit from an investment that is incurred when the investment is sold. When stock shares or any other taxable investment assets are sold, Capital Gain Tax is applied on it. The tax is not applicable for unsold shares or any type of capital.

- The tax is charged under Income-tax Act, 1961. It was introduced for the first time in 1947 but was formally revised in 1950.

- There are two types of Capital gains Tax. These are:

- Short-Term Capital Gains (STCG): It is applicable for assets held for less than 36 months.

- Long-Term Capital Gains (LTCG): It is applicable for assets held for 36 months or more.

- Nature of capital assets is also one of the criteria which decide the rate of taxation under Capital Gains Tax.

- For Example: The STCG arising from the sale of capital assets, such as property, gold, and bonds are taxed as per the individual income tax slab rate.

- LTCG on the sale of such assets are taxed at 20 percent (plus a cess of 3 percent on property and gold) and 10 percent (on bond).

- The LTCG on listed equity shares and equity oriented mutual funds enjoy tax exemption on the condition that the Security Transaction Tax (STT) is paid on purchase of such transactions. While the STCG on listed securities is taxed at flat 15 percent.

Security Transaction Tax (STT)

- STT is levied on turnover where the investor has to pay a small tax on the total consideration paid or received in a share transaction. It was introduced in the Budget of 2004 and implemented in Oct 2004.

- The objective behind this taxation is to mitigate tax evasion as the same is taxed at source. Stocks, futures, options, mutual funds and exchange traded funds come under the ambit of STT.

Equalization Levy

- Equalization Levy (EL) is a tax which is levied on consideration received by a non-resident for specified services such as online advertising or provision of digital space for online advertisement or any other service for the purpose of online advertising.

- The levy has been imposed under the Finance Act, 2016. According to its provision, a person who is resident in India or a non-resident having a permanent establishment in India shall deduct EL at 6% on the consideration paid to non-resident towards specified services.

Direct taxes levied by the State Government

Land Revenue Tax

- Land revenue tax is a fee paid on the purchase of a built property. It is basically the price paid for the ownership of the land to the government according to the specified laws bi-annually or annually.

- There is a significant historical lineage of land taxation across the country as different systems such as Zamindari, Mahalwari and Ryotwari were followed across the country.

Evolution of Indirect Taxes in India

- Indirect tax was first introduced in India in 1944 in the form of excise duty on Indian products as a measure of protection for goods imported from the UK.

- There were several committees which were appointed for this purpose. From there, the process of reforms of indirect taxes in India went through ups and downs till the introduction of the Goods and Services Tax (GST) in 2017.

- Till 2017, there were many taxes which were levied at central and state level. Central indirect taxes were Excise Duty, Customs Duty, Service Tax and Central Sales Tax.

- State’s indirect taxes included Value Added Tax, Entertainment Tax, Luxury Tax, Entry Tax and Stamp Duty.

- However, after introduction of goods and service taxes these taxes were reduced to Central Goods and Service Tax (CGST), Inter-State Goods and Service Tax (IGST), Customs Duty to be levied by centre while State Goods and Service Tax (SGST) and Stamp Duty to be levied by states.

Goods and Service Tax: Necessity, Controversy, Ramifications and Solutions

- Constitution (101st Amendment) Act, 2016 laid to formal implementation of goods and service tax in the country.

- Originally proposed in 2007, the introduction of the Goods and Services Tax (GST) is a very significant step in the field of indirect tax reforms in India. GST was the product of amalgamating a large number of Central and State taxes into a single tax.

Challenges before GST: Streamlining Centre-State Financial Relations

- Before introduction of GST, fiscal powers between the Centre and the States were clearly demarcated in the Constitution with almost no overlap between the respective domains.

- The Centre had the powers to levy tax on the manufacture of goods (except alcoholic liquor for human consumption, opium, narcotics etc.) while the States had the powers to levy tax on sale of goods.

- In case of inter-states sales, the Centre had the powers to levy a tax (the Central Sales Tax) but the tax was collected and retained entirely by the originating States.

- As for services, it was the Centre alone that was empowered to levy Service Tax. Since the States were not empowered to levy any tax on the sale or purchase of goods in the course of their importation into or exportations from India.

- The Centre levied and collected the service tax in addition to the Basic Customs Duty. This additional duty of customs (commonly known as CVD and SAD) was to counterbalance excise duty, sales tax, State VAT and other taxes levied on the like domestic product.

- Introduction of GST required amendments in the Constitution so as to empower the Centre and the States concurrently to levy and collect GST.

Constitution of GST Council

- After the 101st Constitution Amendment Act, 2016 was enacted, the GST Council was notified.

- The Goods and Service Tax Council (GSTC) comprised the Union Finance Minister, the Minister of State(Revenue) and the State Finance Ministers to recommend on the GST rate, exemption and thresholds, taxes to be subsumed and other matters.

- One-half of the total number of members of the GSTC formed a quorum in meetings of the GSTC.

- Decisions in GSTC were taken by a majority of not less than three-fourth of weighted votes cast.

- Centre had one-third weightage of the total votes cast and all the states taken together have two-third of weightage of the total votes cast. All decisions taken by the GST Council arrived at through consensus.

Salient features of GST

Following are the salient features of GST:

- Based on supply of goods or services: GST is applicable on ‘supply’ of goods or services as against the previous concept of the manufacture of goods or on sale of goods or on provision of services.

- Destination-based consumption taxation: It is based on the principle of destination-based consumption taxation as against the present principle of origin-based taxation.

- Types of GST: GST to be levied by the Centre is called Central GST(CGST) and that which is levied by the States would be called State GST (SGST).

- An Integrated GST (IGST) is levied an inter-state supply (including stock transfers) of goods or services.

- It is levied and collected by the Government of India and such tax shall be apportioned between the Union and the States in the manner as may be provided by Parliament by Law on the recommendation of the GST Council.

- Import oriented Goods and Services: Import of goods or services is treated as inter-state supplies and is subject to IGST in addition to the applicable customs duties.

- CGST, SGST & IGST are levied at rates to be mutually agreed upon by the Centre and the States. The rates were notified on the recommendation of the GST Council.

- GST replaced the following taxes currently levied and collected by the Centre:-

-

- Central Excise Duty

- Duties of Excise (Medicinal and Toilet Preparations)

- Additional Duties of Excise (Goods of Special Importance)

- Additional Duties of Excise (Textiles and Textile Products)

- Additional Duties of Customs (commonly known as CVD)

- Special Additional Duty of Customs(SAD)

- Service Tax

- Cesses and surcharges in so far as they relate to supply of goods and services.

- State taxes that have been subsumed within the GST are:-

-

- State VAT

- Central Sales Tax

- Purchase Tax

- Luxury Tax

- Entry Tax (All forms)

- Entertainment Tax and Amusement Tax (except those levied by the local bodies)

- Taxes on advertisements

- Taxes on lotteries, betting and gambling

- State cesses and surcharges in so far as they relate to supply of goods and services.

Exemptions under Goods and Service Tax

- GST is applied on all goods and services except Alcohol for human consumption.

- Currently five specified petroleum products (Crude, Petrol, Diesel, ATF & Natural Gas) has been exempted from GST and are under central and state taxation as they were before i.e. Excise duty is levied by the centre while service tax is levied by the state.

- GSTN Network: The whole GST system has been backed by a robust IT system under an umbrella of Goods and Services Tax Network (GSTN). It has been set up by the Government.

- Goods exempted from taxation: Certain items have been kept untouched from GST taxation. Currently, Contraceptives, semen, human blood, vaccines, organic manure, earthen pots, beehives, live animals (except horses), maps, books, journals, newspapers, non-judicial stamps, kites, and pooja props have been exempted from GST.

- Further, fish, egg, fresh milk, etc. Grapes, melons, ginger, garlic, unroasted coffee beans, green tea leaves that are not processed and food items that are not put into branded containers like rice, hulled cereal grains, wheat, corn, etc. have been exempted from the GST list.

Significance of Goods and Service Tax

- Elimination of cascading effect: GST aimed to mitigate ill effects of cascading or double taxation in a major way and pave the way for a common national market.

- Cascading effect on taxation is a term which is used to define repetitive taxation on manufacturing a single product. AT each level of production the manufacturer had to pay VAT every time it added value to the product.

- Reduction of tax burden: From the consumer’s point of view, the biggest advantage of GST came in terms of reduction in the overall tax burden on goods, which is currently estimated to be around 25%-30%.

- Transparency in taxation system: The introduction of GST has also implied that the actual burden of indirect taxes on goods and services would be much more transparent to the consumer by making tax structure lucid and understandable.

- Increased competitiveness: Introduction of GST has made Indian products competitive in the domestic and international markets. This has happened because of the full neutralization of input taxes across the value chain of production and distribution.

Current Debates on GST:

- Inclusion of petroleum products: Amid rising prices of petroleum prices, it is being debated that it must be brought under GST. Experts thought that it would bring down their prices. However, recently, the 45th GST Council did not recommend bringing petroleum products under the reformed taxation regime.

- GST Compensation: The introduction of the Goods & Services Tax (GST) required States and Union Territories (with Legislature) to subsume their sovereignty in a GST Council.

- It resulted in loss on account of migration from Value Added Tax/Sales Tax to GST to these states and UTs.

- To balance this revenue shortfall, the constitutional amendment has provided for compensation to the States for loss of revenue arising on account of implementation of the Goods and Services Tax for a period of five years.

- The Parliament enacted a law named GST (Compensation to States) Act, 2017, and has been funding states till then. This tenure of this compensation will expire June, 2022.

- There is a constant demand from the states to extend this deadline as according to them, revenue situation is yet to improve on two counts;

- Due to the introduction of the GST and

- Because the pandemic has affected revenue collection.