Status of Economy since Pandemic

Introduction

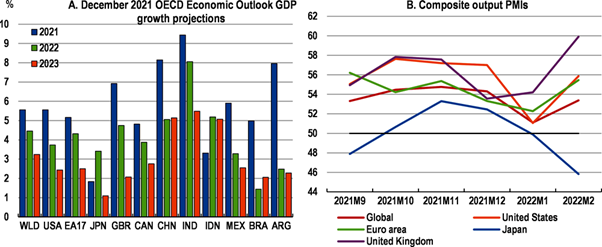

Two years into the COVID-19 pandemic, the global economy continues to be plagued by uncertainty, with resurgent waves of mutant variants, supply-chain disruptions, and a return of inflation in both advanced and emerging economies. Moreover, the likely withdrawal of liquidity by major central banks over the upcoming years may also make global capital flows more volatile. In this context, it is important to evaluate both the pace of growth revival in India as well as the strength of macro-economic stability indicators.

Background

- Before COVID-19, the biggest pandemic in modern history was the Spanish Flu of 1918 and 1919, during which many service-based businesses suffered double-digit losses.

- The International Monetary Fund (IMF) estimated that the global economy declined more than 3% in 2020, grew 5.9% in 2021, and will grow 4.9% in 2022.

- Though certain industries, such as travel and hospitality, felt the pandemic’s impact most directly, the effect also spread to unrelated industries.

- Government interventions during the pandemic, such as several stimulus packages, helped the U.S. economy rebound.

- Post-COVID recovery of the economy was mainly supported by the governmental interventions with slightly slow but gaining pace during

- Though the Russia-Ukraine War in 2022 has again led to global supply chain disruptions due to which economy hitted.

- Inflation and Global hike in fuel prices have made it worse.

Causes of the Economic Downfall across the World

- COVID-19 outbreak: The International Monetary Fund (IMF)observed that the global economy is contracted sharply in 2020 due to the lockdown.

- Post-pandemic recovery: World merchandise trade has plumed by between 13% and 32% in 2020 due to the Covid-19 pandemic.

- Russia-Ukraine War: The economic impact of the 2022 Russian invasion of Ukrainebegan in late February 2022, in the days after the Russian Federation recognized two break-away Ukrainian republics and commenced a war in Ukraine.

- Russia has responded with sanctions of its own. Both the conflict and the sanctions have had a strongly negative impact on the world economic recovery during the COVID-19 recession. As a result of its war, estimates of a 30-year economic setback are projected for Russia.

- Hike in Global Fuel Prices: Higher oil prices contribute to inflation directly and by increasing the cost of inputs.

Impacts on Economy

- Unemployment: The national unemployment rate climbed as high as 14.8% in April 2020 before dropping to 6.2% in February 2021. By November 2021, it had dropped to 4.2%.

- Inflation: Oil's potential to stoke inflation has declined as the U.S. economy has become less dependent on it. Oil prices exert a greater influence on producer prices because of oil's role as a key input.

- Global economy Contracted: In October 2021, the International Monetary Fund (IMF) revealed that the global economy contracted by 3.1% in 2020—the worst slide in recent memory.

- Demand and Supply disruptions: A recent rise in COVID-19 infections due to the highly contagious Omicron variant could hinder the global economic recovery by exacerbating supply chain problems and depressing demands.

Sectors affected by the Economic Slowdown

While some industries are very susceptible to economic changes, other sectors tend to perform well during recessions. The sectors impacted were:

- Tourism Sector: The tourism and travel sector that employs millions of Indians started bouncing back after the first wave of COVID until it was hit by the second round of COVID.

- The tourism sector, which contributes nearly 7% of India's GDP.

- Automobile Sector: The second wave has interrupted the sales momentum recorded by the automobile industry in third and fourth quarter of the financial year 2021.

- Accordingly, many original equipment manufacturers (OEMs) have advanced maintenance shutdowns to April and May on account of dampening consumer sentiments, closure of automotive dealerships, as well as supply-side constraints.

- Real Estate and Construction Sector: According to a report, Indian house prices will stagnate this year, as the slowdown has crushed demand. This has offset government tax rebates and incentives for property developers.

- Oil related Industries: As the fuel prices hiked, the industries hit hard due to increase in supply cost and raw materials costs. However, the fuel hike affects almost every section of the society.

Why Inflation is so persistent among all the causes?

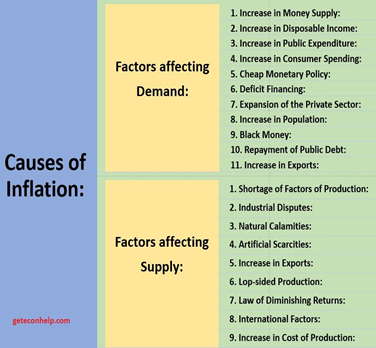

- Inflation is a general rise in the price level of most goods and services in an economy over a period of time, resulting in a sustained drop in the purchasing power of currency.

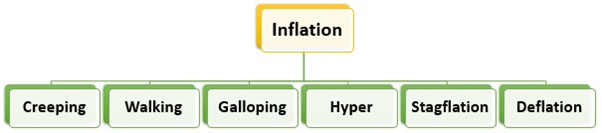

Types of Inflation:

Currently the major effect that world is facing is due to stagflation since COVID-19. So what does it mean?

- Stagflation is a combination of stagnant economic growth, high unemployment, and high inflation.

Causes of stagflation

- Oil price rise: Stagflation is often caused by a supply-side shock. For example, rising commodity prices, such as oil prices, will cause a rise in business costs (transport more expensive) and short-run aggregate supply will shift to the left. This causes a higher inflation rate and lower GDP.

- Powerful trade unions: If trade unions have strong bargaining power – they may be able to bargain for higher wages, even in periods of lower economic growth. Higher wages are a significant cause of inflation.

- Falling productivity: If an economy experiences falling productivity – workers becoming more inefficient; costs will rise and output fall.

- Rise in structural unemployment: If there is a decline in traditional industries, we may get more structural unemployment and lower output. Thus we can get higher unemployment – even if inflation is also increasing.

|

Globally considered recessions includes

|

Government Steps for Economic Recovery

In an ideal scenario, legislatures and central banks use the power of the money to help mitigate an economic crisis.

Around World

- Efforts to open up the S. Treasury and send money directly to households helped newly unemployed individuals and those with reduced working hours.

- And interest rate cuts helped to boost liquidity at a time when money was tight. The Fed slashed a key rate to near zero in March 2020.

In India

- By Government

- Disinvestment: Disinvestment is when governments or organizations sell or liquidate assets or subsidiaries. Disinvestments can take the form of divestment or a reduction of capital expenditures (CapEx).

- Schemes and Policies: Like Pradhan Mantri Garib Kalyan Package 50.78 crore person-days of employment was generated incurring an expenditure of Rs. 39,293 crore.

- Emergency Credit Line Guarantee Scheme (ECLGS), to provide Collateral-free Automatic Loans for Businesses.

- By the Central Bank

- Increase in Interest rates: When it needs to absorb money to reduce inflation, the central bank will sell government bonds on the open market, which increases the interest rate and discourages borrowing.

- Open market operations: The central bank performs open market transactions (OMO) that either inject the market with liquidity or absorb extra funds, directly affecting the level of inflation.

Way forward

- The current crisis is the first of this severity to hit OECD countries, since they have shifted to knowledge-based service economies where investment in intangible assets is of equal importance as investment in machinery, equipment and buildings.

- The OECD is developing a strategic response to the crisis focusing on two priority areas: finance, competition and governance; and restoring long-term growth.

- As part of this strategic response, the OECD Directorate for Science, Technology and Industry (DSTI) has analysed the likely impact of the downturn on the drivers of long term economic growth and the innovation-related items in policy responses of major countries.

- Special workshops and sessions on the economic crisis were held by the Committee for Innovation, Industry and Entrepreneurship, the Committee for Scientific and Technological Policy, and the Committee for Information, Computer and Communications Policy.

- Efforts to stimulate the economy need to both reflect the current drivers of economic growth and take advantage of the process of “creative destruction” to accelerate structural shifts towards a stronger and more sustainable economic future.

- Innovation policies need to be adapted to current conditions both in terms of how such policies are crafted to work, but also as elements of stimulus packages that may often be the foundation for these medium- and long-term initiatives.

Conclusion

The financial system is always a possible area of stress during turbulent times. However, India’s capital markets, like many global markets, have done exceptionally well and have allowed record mobilization of risk capital for Indian companies. More significantly, the banking system is well capitalized and the overhang of Non-Performing Assets seems to have structurally declined even allowing for some lagged impact of the pandemic.