Revised Priority Sector Lending (PSL) Guidelines

- Posted By

10Pointer

- Categories

Economy

- Published

8th Sep, 2020

-

- Recently, the Reserve Bank of India (RBI) released revised Priority Sector Lending (PSL) guidelines.

- It aligns with emerging national priorities and also bring sharper focus on inclusive development.

- The PSL guidelines were last reviewed for commercial banks in April 2015 and for Urban Co-operative Banks (UCBs) in May 2018.

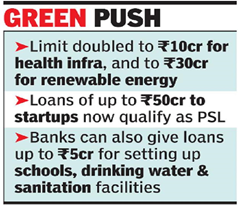

- Additional Categories covered under to PSL are

- Bank finance to start-ups up to Rs. 50 crore,

- Loans to farmers for installation of solar power plants for solarisation of grid connected agriculture pumps.

- Loans for setting up Compressed Biogas plants.

- Revised Guidelines includes the following

- Higher credit limit has been specified for Farmers Producers Organizations (FPOs) undertaking farming with assured marketing of their produce at a predetermined price.

- It has defined farmers with land holding of up to one hectare as marginal farmers, and farmers with a landholding of more than one hectare and up to 2 hectares as small farmers.

- The credit limits for renewable energy, health infrastructure, including the projects under ‘Ayushman Bharat’, have been doubled.

- Higher weightage has been assigned to priority sector credit in ‘identified districts’ where priority sector credit flow is comparatively low.

- The RBI mandates banks to lend a certain portion of their funds to specified sectors, like

- Agriculture,

- Micro, Small and Medium Enterprises (MSMEs),

- Export credit,

- Education,

- Housing,

- Social infrastructure,

- Renewable energy.

- All scheduled commercial banks and foreign banks (with a sizable presence in India) are mandated to set aside 40% of their Adjusted Net Bank Credit (ANDC) for lending to these sectors.

- Regional rural banks, co-operative banks and small finance banks have to allocate 75% of ANDC to PSL.