Federalism and India’s Human Capital

Human Capital’ is defined as the intangible collective resources possessed by individuals and groups within a given population. These resources include all the knowledge, talents, skills, abilities, experience, intelligence, training, judgment, and wisdom possessed individually and collectively, the cumulative total of which represents a form of wealth available to nations and organizations to accomplish their goals.

The major pillars to determine the quality of Human Capital possessed by a nation comprise of ‘health’ and ‘education’ indicators. A country like India which is characterized by the youngest population in the world and a huge chunk of humans to look after needs to focus exceedingly on human capital to ensure that everyone experiences at least the basic standards of living. However, the major indicators pertaining to the human capital of India paint a rather worrisome picture of the current state of affairs.

For Example:

- As per the Human Capital Index released by World Bank (2020 Report), India has been ranked 116 out of 174 countries.

- The National Family Health Survey-5 for 2019-20 has shown that malnutrition indicators have stagnated or turned worse in most States. Several States have experienced an increase in child stunting (children having low height for their age) as well as child wasting (children having low weight for their height)

- The National Achievement Survey 2017 and the Annual Status of Education Report 2018 bring out the poor learning outcomes prevailing in the country with several school going children having difficulty in solving basic arithmetic problems and lacking basic reading skills

It must be acknowledged that India has been a ‘welfare State’ and several government initiatives over the years have tried to improve such indicators. The National Health Policy 2017 clearly highlighted the need for interventions to address malnutrition. Several flagship initiatives like the PoshanAbhiyaan, Mission Poshan 2.0 and Samagra Shiksha Abhiyan are testimony to the fact that the government is well aware of its responsibility to work on improving the human capital.

Still why the country’s performance is so poor as per the indicators?

Such a question does not have any direct and concrete answer. But an introspection into the possible reasons for the poor performance point towards the ‘quantum’ and ‘distribution’ of the investments that the country makes over building human capital.

- On ‘quantitative’ terms, India spends only 4% of its GDP as public expenditure on human capital (which comprises of around 1% on health and around 3% on education). With such a meagre spending in such vital areas India ranks as one of the lowest among its peers.

- In terms of ‘distribution’, several issues have been noticed in the manner these investments have been made. International experience suggests that one reason why these interventions are not leading to better outcomes may be India’s record with ‘fiscal de-centralisation’. It basically points out to the deficiencies that the country is experiencing because of a skewed distribution of revenue between the Centre and the States.

Understanding the scope of Fiscal Decentralisation in India:

Fiscal Decentralisation denotes the sharing of revenue between the Central and the State Governments for carrying out the developmental policies. Centre-State fiscal arrangements entail a sizeable redistribution of resources across the Indian States. Further, the third tier of government (Panchayats and Urban Local Bodies) are dependent majorly on the State governments for their revenues. This overall arrangement is complicated due to the multitude of parameters to be taken care of while deciding about the flow of revenue from one tier of the government to the other.

Fiscally, while the Constitution as per the Seventh Schedule assigns bulk of the expenditure responsibilities to States, the major sources of revenue has been assigned to the Centre. This leads to a ‘vertical imbalance’ wherein the States’ revenue is not sufficient to look after the expenditure requirements.

In order to address this imbalance, the Constitution provides for fiscal transfers from the Centre to the States in the following manners:

- As per Article 270 certain Taxes have to be levied and collected by the Union and distributed between the Union and the States

- As per Article 275 there shall be grants-in-aid from the Centre to the States from the Consolidated Fund of India.

- As per Article 280 the Finance Commission has to be constituted every 5 years for making recommendations regarding distribution of the net proceeds of taxes between the Centre and the States as well as principles which should govern the grants in aid of the revenues of the States out of the Consolidated Fund of India

- As per Article 282 the Centre (as well as States) can make ‘grants for any public purpose’. This article has been utilized by the Central Ministries to transfer funds to the States via several Centrally Sponsored Schemes (CSS). It is basically an executive action, which does not require the Parliament’s approval.

Apart from this, transfers between the Centre and the States have been made by bodies like the Planning Commission, which had majorly overshadowed the vital functioning of the Finance Commission in India.

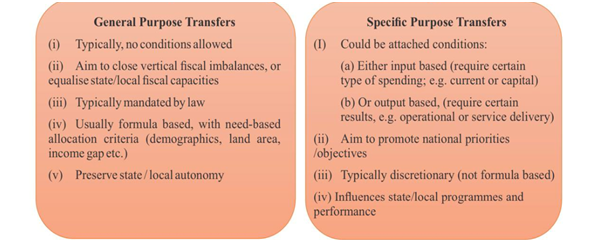

There are different ways to classify the fund transfers that occur between the Centre and the States, like:

- Based on conditions attached for the transfers – Fiscal transfers that are part of tax devolution are unconditional in nature, while transfers under grants-in-aid or Centrally Sponsored Schemes are generally conditional in nature which are made only after the prescribed conditions are satisfied.

- Based on Purpose of Transfers – It can be understood from the following graphic:

Between these, the tax devolutions would come under the General-Purpose Transfers while the CSS transfers would come under Specific Purpose Transfers.

What have been the concerns regarding Fiscal Decentralisation in India?

1. The quantum of fiscal decentralization has been below expectation:

- In recent years, India has taken some steps towards decentralization. The Fourteenth Finance Commission had increased the share of the States in the total divisible pool from 32% to 42%. The divisible pool of taxes comprises total central taxes (excluding the revenue from earmarked taxes) minus the revenue from cesses and surcharges and cost of collecting the taxes. The Fifteenth Finance Commission has also effectively retained this figure of decentralization.

- However, it has to be noted that the sharp increase in tax devolution by the 14th Finance Commission though resulted in the share of general-purpose transfers rising significantly, this was countered by the central government’s move of reducing the specific-purpose transfers that the Centre was giving to the States to implement developmental schemes. As a result, the move fell short of realizing any significant fiscal decentralization.

2. The menace of transfers through the Centrally Sponsored Schemes (CSS):

- The CSS have formed a sizeable chunk of intergovernmental fiscal transfers over the years, comprising almost 23% of transfers to States in 2020-21.

- The CSS require the State governments to contribute some percentage of funds towards implementation of developmental policies framed by the Centre, while the rest of the contribution is done by the Centre. The point of concern is that these transfers from the Centre to the States are beyond the scope of the Finance Commission and are majorly managed by the ministries of the government. This is against what the Constitution would have originally wanted.

- Also, through the CSS the Centre is often seen as intruding into the domain of the responsibilities of the States and violating the distribution of powers between Centre and States as per the Seventh Schedule of the Constitution.

- The transfers through CSS are discretionary, large and often distort the designs of the State government schemes even if they are better and more advanced. This leads to gaps in the achievement of essential human capital indicators.

3. Article 282 vs Article 275:

- The transfers through CSS are carried out under the provision of Article 282 of the Constitution which is listed as a “Miscellaneous Financial Provision”, unlike Articles 270 and 275 which fall under “Distribution of Revenue between Union and States”.

- As per constitutional expert Nani Palkhivala, Article 282 is more of a residuary power and was not intended to be one of the major provisions for making readjustments between the Union and the States. He opined that grants-in-aid under Article 275 as per Finance Commission recommendations are the more appropriate, regular route.

- The Supreme Court in Bhim Singh vs Union of India had observed that “Article 282” is normally meant for special, temporary or ad-schemes”.

- Thus, the use of Article 282 through CSS by the Centre for fund transfers is not in line with the spirit of the constitution for fiscal federalism.

4. The increasing quantum of cesses:

- As per the recent report of the Fifteenth Finance Commission, the tax revenue of the Union and States in India stood at about 17%of GDP in 2018-19 and has remained broadly constant since the early 1990s. But at the same time, cesses and surcharges earmarked by the Union government have grown over time, amounting to 15% of its gross revenues, reducing the proportion of Union revenue eligible for transfers to States from the divisible pool.

5. Fiscal Imbalance at the Third-tier of Government:

- The 73rd and 74th Amendments bolstered decentralization by constitutionally recognizing panchayats and municipalities as the third tier and listing their functions in the Eleventh and Twelfth schedules, respectively. However, it is let to the States to determine how they are empowered, resulting in vast disparities in the roles played by the third-tier governments.

- Many States have not clearly demarcated or devolved functions and funds for panchayats and municipalities.

- Further, third-tier governments are not fiscally empowered either. The Constitution envisages State Finance Commissions (SFCs) to make recommendations for matters such a tax devolution and grants-in-aid to the third tier. However, many States have not constituted or completed these commissions on time, and hence, the Fifteenth Finance Commission has recommended no grants after March 2024 to any State that does not comply with the constitutional provisions pertaining to SFCs.

Recommendations for way-forward:

- To begin with, the Centre needs to rethink the nature of its actions. It should play an enabling role, for instance, encouraging knowledge-sharing between States. For States to play a bigger role in human capital interventions, they need adequate fiscal resources.

- The Centre should refrain from offsetting tax devolutions by altering cost sharing ratios of CSSs and increasing cesses. Indeed, the heavy reliance on CSSs should be reduced, and tax devolutions and grants-in-aid should be the primary sources of vertical fiscal transfers as per the recommendations of the Finance Commission of India.

- Panchayats and municipalities need to be vested with the funds, functionaries and functions listed the Eleventh and Twelfth Schedule respectively. The functions like education, health and sanitation, and social welfare for the Panchayats along with public health and socio-economic development planning for municipalities are ones which are extremely important for building true human capital.

Conclusion

The overall development of the human aspects in the development story of India can only be achieved by harnessing the full potential of sub-national governments. For this, the Union government needs to look after the over-arching framework while the States and Panchayat/Municipalities need to work on the ground with the people. This can only be achieved with proper fiscal decentralization as per the true spirit of the framers of our Constitution.