Changes in Tax rate

-

Context

The Goods and Services Tax Council (GST) at its 47th meeting convened a series of rate changes as part of the restructured tax rates with withdrawal of certain exemptions from what may be a precursor to a complete textile repairs and future adjustments.

-

Background

- Last year, in recognition of the trend of lowering income levels, the GST Council decided to consider a series of measures that include adjusting rates in order to adjust the distorted tax framework and restructure the rates structure to further increase revenue.

- The move comes four years after the issuance of GST, acknowledging that a series of price reductions over the years of more than 500 items has caused financial constraints for both central and provincial governments with rising revenue expectations.

- The GST Council within one year of the July 2017 issue had reduced prices. The rate dropped to more than 350 items on 1,211 items in five broad categories of zeros, 5 percent, 12 percent, 18 percent and 28 percent under GST estimated to result in a loss of approximately Rs.70,000 crore per year.

- The pandemic induced lockdowns have worsened the revenue collection by the states and Centre, increasing the dependency on the compensation by the states, urged the demand for the tax rationalization by the government.

-

Analysis

What are the proposed changes?

Commodities/Items

Hike from

Hike to

Household items such as LED lamps, printing/drawing ink, power driven pumps, Tetra Pak

12%

18%

Solar water heaters, finished leather

5%

12%

Cut and polished diamonds

0.25%

1.5%

Issuance of cheques

0%

18%

Pre-packaged and pre-labelled food items

0%

5%

Orthopedic Appliances

12%

5%

Ropeways services

18%

5%

Other recommendations

- The Group of Ministers (GoM) has finalized a uniform tax rate of 28% on all the three categories; casinos, horse racing and lottery.

- The pre-packed item like, grains wheat, rice and meat will be taxed at 5% par to the branded company with an exemption on frozen food items.

- Exemptions were also withdrawn for room rents:

- 12% GST will now be levied on hotel rooms with rent up to Rs 1,000 a day and;

- 5% GST will be levied on hospital room rent above Rs 5,000 per day (excluding ICU).

- The GoM on system reforms has suggested extra measures for physical verification at the time of registration for high-risk taxpayers including biometric authentication, geo-tagging, Use of electricity data and real-time monitoring of bank accounts.

- Mandatory generation of e-way bills by states for intra-state transportation of gold and precious stones with minimum threshold of 2 lakh was also approved.

-

What are the rationales behind the changes in tax rates?

- Revenue shortfall: States have experienced a shortfall in the revenue collection due to the implementation of GST in the year 2017.

- Dependency on Compensation: The central government had promised to compensate the shortfall in revenue collection by the states due to implementation of GST. Despite an uptick in GST revenues, states with a heavy dependence on compensation may find FY23 to be a challenging year.

- Effect of pandemic: Pandemic had impacted the economic activity and further worsened the revenue collection by the states and the Centre.

- Revenue leakage: There were also concerns regarding disputes and revenue leakage which led to withdrawal of exemptions of pre-packaged items. Some companies were seen to be misusing the provision of exempting unlabeled food items by not registering them.

- Input tax credit: Inverted duty structure on several products has resulted into the accumulation of input tax credit which needs to be refunded.

Inverted Duty Structure:

An inverted duty structure arises when the taxes on output or final product are lower than the taxes on inputs.

-

What are the possible impacts?

Changes in the tax rate and rationalization of the tax rate will create both positive and negative impact on the Economy.

Positive impacts:

- Revenue stability: Increase in tax rate will provide a stable base to the revenue collection of the government.

- More welfare schemes: Better revenue collection will give impetus to the government to introduce more welfare schemes for the socially and economically marginalized sections of the society.

- Narrowing down the fiscal deficit: More revenue will narrow down the fiscal deficit of the government.

- Compensation promise: Compensation promise done by the central government to the states in case revenue shortfall due to GST implementation can be mobilized by the surplus revenue collection.

Negative impacts:

- Inflation: Imposition of more taxes on the consumer goods would result in inflationary pressure in the economy.

- Burden on the consumer: More indirect tax on the goods and services will increase the tax burden on the consumers.

- Reduction in purchasing power: Taxation increases the price of the product, thus, reduces the purchasing power of the consumers.

- Eradication of aggregate demand: Reduction in purchasing power leads to decrease in the aggregate demand from the economy.

- Fewer saving: Increase in the price of the commodity induces the decrease of the savings in the economy, as consumers have to pay more for the same basket of commodities.

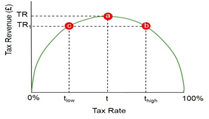

Laffer curve

- The Laffer curve is a theory formalized by supply-side economist Arthur Laffer to show the relationship between tax rates and the amount of tax revenue collected by governments.

- The curve is used to illustrate the argument that sometimes cutting tax rates can result in increased total tax revenue.

-

Conclusion

Rising prices for daily commodities such as LED lights and packaged foods such as wheat flour, paneer, curd, lassi are expected to cause inflation in companies and are expected to add to inflation problems. On the other hand more revenue collection will provide a stable base for the more welfare schemes and scope for more expenditures. It is also important to consider the rationalization of the tax rate accordance with the Laffer curve to ensure better tax base with optimum tax rate.