Seven Years of Pradhan Mantri Jan Dhan Yojana

Recently, the National Mission for Financial Inclusion has completed seven years of successful implementation.

Context

- Recently, the National Mission for Financial Inclusion has completed seven years of successful implementation.

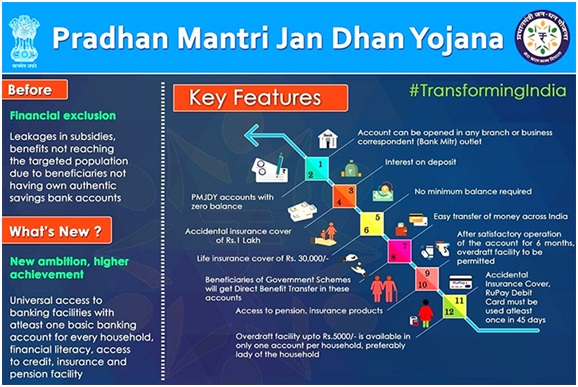

About the Scheme

- Pradhan Mantri Jan-Dhan Yojana (PMJDY) was launched by Narendra Modi on 28th August 2014.

- It is a national mission with an aim to provide access to various financial services including-

- Remittance

- Credit

- Insurance

- Pension

- Banking Savings

- Deposit Accounts in an affordable manner

Objectives

- To ensure access of financial products & services at an affordable cost.

- Use of technology to lower cost & widen reach.

Benefits provided under this scheme

- The scheme covers both the urban as well as rural areas and provides an indigenous Debit Card (RuPay card) to each of its account holders.

- No minimum balance is required for opening an account under this scheme. The beneficiary can open his/her account in any bank branch or Business Correspondent outlet at zero balance.

- It provides a Core Banking System (CBS) along with mobile banking using USSD facilities. A facility of call center and a toll-free number is available nationwide.

- Pradhan Mantri Jan Dhan Yojana provides each beneficiary with basic banking accounts with a debit card with inbuilt accident insurance.

Six Pillars of the Scheme

- Universal Access to Banking Services- Branch and Banking Correspondents.

- Accounts opened are online accounts in the core banking system of banks.

- Focus has shifted from ‘Every Household’ to Every Unbanked Adult’.

- Basic Savings Bank Accounts with OverDraft (OD) Facility of Rs. 10,000/- to every household.

- Financial Literacy Program– Promoting savings, use of ATMs, using basic mobile phones for banking, etc.

- Interoperability through RuPay debit card or Aadhaar enabled Payment System (AePS).

- Creation of Credit Guarantee Fund – To provide banks some guarantee against defaults.

- Insurance – Free accidental insurance cover on RuPay cards increased from Rs. 1 lakh to Rs. 2 lakh for PMJDY accounts opened after August 2018.

- Pension Scheme for the unorganized sector.

Current status of the Scheme

- 5 crore PMJDY account holders receive direct benefit transfer (DBT) from the Government under various schemes.

- Total deposit balances under PMJDY Accounts stand at Rs 1,46,230 crore.

- PMJDY Accounts have grown three-fold from 14.72 Crore in March 2015 to 43.04 Crore as on August 18, 2021.