Rising bond yield hurts equity market

Over the past few days, a surge in bold yields has contributed to steep fall in equity markets.

Context

Over the past few days, a surge in bold yields has contributed to steep fall in equity markets.

What is bond yield?

- The yield of a bond is the effective rate of return that it earns. But the rate of return is not fixed — it changes with the price of the bond.

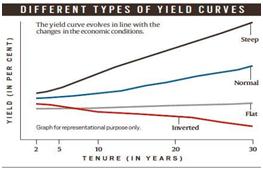

What do different types of bond yield curve signify?

- Yield inversion happens when the yield on a longer tenure bond becomes less than the yield for a shorter tenure bond.

- A yield inversion typically portends a recession.

- An inverted yield curve shows that investors expect the future growth to fall sharply; in other words, the demand for money would be much lower than what it is today and hence the yields are also lower.

- A steep yield curve when there is a large spread in interest rates between shorter-term bonds to longer-term bonds — often precedes a period of economic expansion, as investors bet that a central bank will be forced to raise rates in the future to tamp down higher inflation.

- In normal bond yield this positive slope reflects investor expectations for the economy to grow in the future and, importantly, for this growth to be associated with a greater expectation that inflation will rise in the future rather than fall.

- This expectation of higher inflation leads to expectations that the central bank will tighten monetary policy by raising short-term interest rates in the future to slow economic growth and dampen inflationary pressure

How rising bond yield affects market sentiment?

- Investors believe having better return in bond market rather than equity (stock market).

- So there money shifts it position by triggering a sale of shares and investing same money in bonds.