Refund of input tax credit for input services cannot be claimed: Supreme Court

The Supreme Court said that refund of tax credit cannot be claimed for input services under the Goods and Services Tax regime’s inverted duty structure.

Context

The Supreme Court said that refund of tax credit cannot be claimed for input services under the Goods and Services Tax regime’s inverted duty structure.

What is Input Tax Credit?

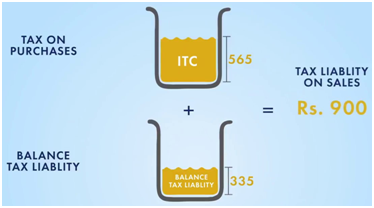

- Input credit means at the time of paying tax on output, one can reduce the tax that have been already paid on inputs.

- In simple words, input tax credit is tax reduced from output tax payable on account of sales.

For example

|

Key-highlights of the Judgment

- SC confirmed a Madras High Court judgment which upheld a fiscal formula included in the Central Goods and Service Tax Rules to execute refund of unutilised Input Tax Credit (ITC) accumulated on account of input services.

- The court passed the judgment in the face of two contradicting judgments of Gujarat and Madras High Courts on the validity of Rule 89(5) of the Central Goods and Service Tax Rules, 2017.

- Rule 89(5) provides a formula for the refund of ITC, in “a case of refund on account of inverted duty structure”.