Framework for Regulatory Sandbox introduced

The International Financial Services Centers Authority (IFSCA) has introduced a Framework for Regulatory Sandbox to tap into innovative FinTech solutions

- The International Financial Services Centers Authority (IFSCA) has introduced a Framework for Regulatory Sandbox to tap into innovative FinTech solutions.

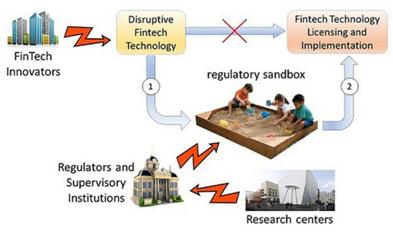

- What is a regulatory sandbox?

- It is a safe harbour, where businesses can test innovative products under relaxed regulatory conditions. Typically, participating companies release new products in a controlled environment to a limited number of customers for a limited period of time.

- It is a safe harbour, where businesses can test innovative products under relaxed regulatory conditions. Typically, participating companies release new products in a controlled environment to a limited number of customers for a limited period of time.

- Under this Sandbox framework, entities operating in the capital market, banking and insurance and financial services space shall be granted facilities to experiment with innovative FinTech solutions in a live environment with a limited set of real customers for a limited time frame.

- These features shall be fortified with necessary safeguards for investor protection and risk mitigation.

- The Regulatory Sandbox shall operate within the IFSC located at GIFT City.

- The creation of an “Innovation Sandbox” is proposed as an additional step towards creating an innovation-centric ecosystem in the IFSC.

- The Innovation Sandbox will be managed and facilitated by the Market Infrastructure Institutions (MIIs) operating within the IFSC.

- IFSCA has an objective to develop a world class FinTech hub at the IFSC in GIFT City, Gandhinagar (Gujarat).

- Thus, it endeavors to encourage the promotion of financial technologies (‘FinTech’) initiatives in financial products and services across the fields of banking, insurance, securities and fund management.

- “Regulatory Sandbox” is a step towards attaining this vision.