Displeasure over recommendations of 15th Finance Commission based on Terms of Reference

Context

In the interim budget speech of Tamil Nadu Assembly, the Deputy CM has expressed his disappointment over recommendations of 15th FC citing reduction in revenue deficit grants and local body grants.

What is finance commission?

- The Finance Commission is constituted by the President under Article 280 of the Constitution, to make recommendations to the President as to—

- the distribution between the Union and the States of the net proceeds of taxes which are to be, or may be, divided between them and the allocation between the States of the respective shares of such proceeds

- the principles which should govern the grants-in-aid of the revenues of the States out of the Consolidated Fund of India

- the measures needed to augment the Consolidated Fund of a State to supplement the resources of the Panchayats in the State on the basis of the recommendations made by the Finance Commission of the State

- the measures needed to augment the Consolidated Fund of a State to supplement the resources of the Municipalities in the State on the basis of the recommendations made by the Finance Commission of the State

- any other matter referred to the Commission by the President in the interests of sound finance

What were the Terms of Reference (ToR) of 15th FC?

The Terms of Reference (ToR) of the Commission were wide-ranging and unique in many respects, like:

- The Commission used the population data of 2011 while making its recommendations.

- The impact on the fiscal situation of the Union Government of substantially enhanced tax devolution to States following recommendations of the 14th Finance Commission

- Efforts made by the States in expansion and deepening of tax net under GST

- Efforts and Progress made in moving towards replacement rate of population growth

- Achievements in implementation of flagship schemes of Government of India, disaster resilient infrastructure, sustainable development goals, and quality of expenditure

Inter-state transfers & Security Expenditure

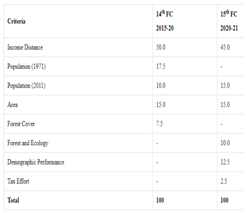

- For the horizontal inter-se transfers among the states, the 15th FC has assigned:

- 45 per cent weightage to ‘income distance’

- 15 per cent each to the ‘2011 population’ and the ‘area’ of the state

- 5 per cent to ‘demographic performance’

- 5 per cent to ‘tax effort’

- For security related expenditure 15th FC has recommended:

- setting up of a non-lapsable defence fund

- levy of a cess

- monetisation of surplus land and other assets

- tax-free defence bonds

- utilising proceeds of disinvestment of defence public sector undertakings

What is the controversy?

- 15th FC was mandated to use the population data of 2011 census.

- But 14th FC had used the data of 1971 census hence southern states who were implementing population control measures since a long time were now at loss.

- ToR like deepening tax net under GST, achievements in implementation of flagship schemes of Govt of India are highly subjective and some states can be at disadvantage.

- 14th FC has recommended 42% devolution of taxes to the states but 15th FC has recommended 41% share to the states because of JAMMU AND KASHMIR REORGANISATION ACT, 2019, which has changed the status of earstwhile JnK to UT of JnK and UT of Lakadh