Adjusted gross revenue (AGR)

- Posted By

10Pointer

- Categories

Economy

- Published

3rd Sep, 2020

-

- The Supreme Court has allowed telecom companies 10 years’ time to pay their adjusted gross revenue (AGR) dues to the government.

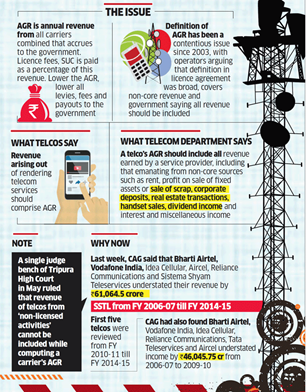

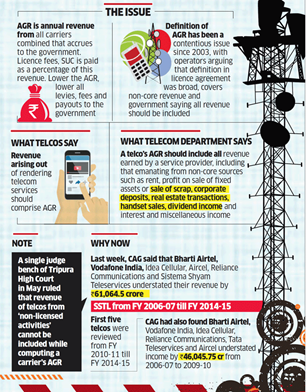

- Adjusted Gross Revenue (AGR) is the usage and licensing fee that telecom operators are charged by the Department of Telecommunications (DoT).

- It is divided into spectrum usage charges and licensing fees, pegged between 3-5 per cent and 8 per cent respectively.

- As per DoT, the charges are calculated based on all revenues earned by a telco – including non-telecom related sources such as deposit interests and asset sales.

- The telecom sector was liberalised under the National Telecom Policy, 1994 after which licenses were issued to companies in return for a fixed license fee.

- However, to provide relief from the steep fixed license fee, the government in 1999 gave an option to the licensees to migrate to the revenue sharing fee model.

- The DoT argued that AGR includes all revenues (before discounts) from both telecom and non-telecom services.

- The companies claimed that AGR should comprise just the revenue accrued from core services and not dividend, interest income or profit on sale of any investment or fixed assets.